The introduction of the blockchain technology continues to grow in various industries: logistics, supply chains, traditional asset classes such as real estate, trading and consumer payment systems, as well as asset trading platforms. There is an expectation that blockchain or distributed ledger technologies (DLT) will eventually become the standard channel for completing transactions and transferring value. By eliminating the financial and temporal burden of intermediaries, automatically executed and automatically applied smart contracts provide a reliable method for exchanging peers at a price that is lower than traditional channels.

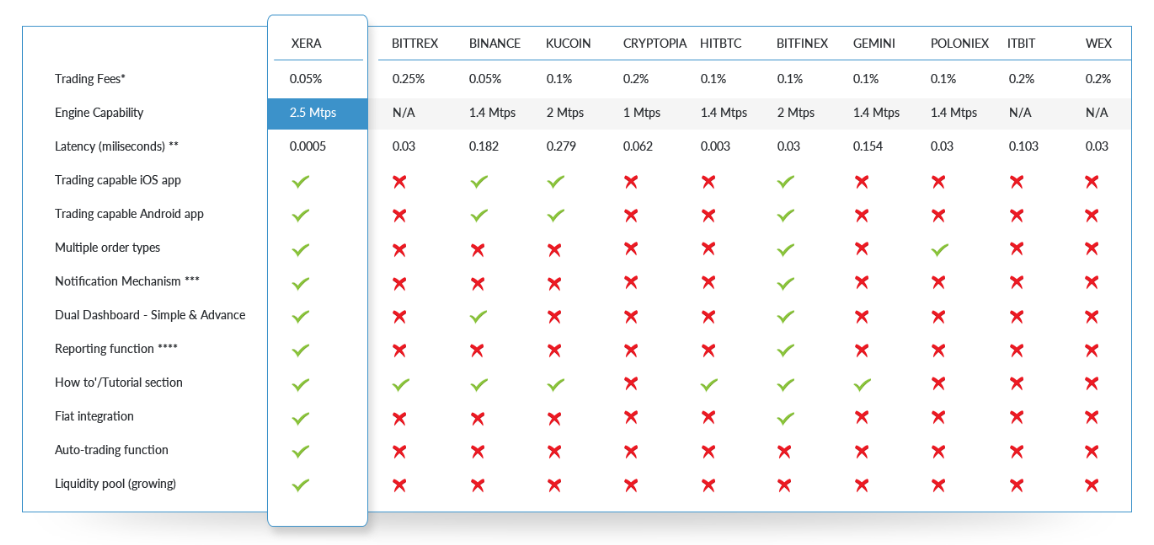

Most blockchains and cryptocurrency projects issue their own tokens or coins that are traded on cryptocurrency exchanges. Cryptocurrency trading is a 24/7 trading platform that corresponds to buyers and sellers of various currencies. This is similar to stock trading or Forex, where the value of the instrument will move based on several factors. Despite the presence of several exchanges in different geographic locations, there are still significant gaps in the functionality of these exchanges. Some of the key problems in existing trading markets include security problems, lack of liquidity, problems with latency, and a very limited selection of automated functions — all the features that traders expect.

PROBLEMS:

Since the creation of Bitcoin in 2009, hundreds of altcoins were created. In terms of the overall cryptocurrency landscape, the market capitalization of the emerging industry ranged between $ 282B and $ 598B in the first half of 2018. However, the number of ICOs launched in 2018, which exceeds 500 at the moment, is ahead of the total number of ICOs (210) that entered the market in 2017. Indeed, as of mid-2018, the new ICOs collected more than $ 12B per year, which is more than twice the 2017 estimate of $ 3.8 B. As we can see, interest in ICO, as well as in cryptocurrency trading, continues to grow.

Astronomical forecasts of Bitcoin’s future market capitalization, in particular, can be far stretched at the moment. However, as the blockchain technology develops and matures, the cost increase has a high probability of continuation, since the goal of widespread adoption has not yet been realized. Indeed, industry giants such as Goldman Sachs4, JP Morgan, Berkshire Hathaway, Microsoft, Wal-Mart, Google, and China5 industrial and commercial bank, either moved forward with projects on the blockchain, or they filed patents on the blockchain technology, thereby signaling its current intention to turn on the blockchain-based system. Due to the continued interest in using blockchain and cryptocurrency technology, hundreds of cryptocurrency exchanges around the world were created to allow investors to access the cryptocurrency market.

Currently, there are more than 500 cryptocurrency exchanges located in different geographic locations, but the main functional gaps continue to haunt these exchanges. Some of the key problems for existing cryptocurrency trading exchanges include liquidity, security, latency problems and the lack of automated functions. Each of these problems leads to limitation and frustration for both experienced and new traders.

There are several main problems:

Liquidity issues

Security questions

Limited coin selection

Limited functionality

SOLUTIONS FROM XERA

XERA will address the challenges and challenges faced by cryptocurrency exchange traders, providing an integrated solution for traders and investors interested in the cryptocurrency market. XERA will provide professional tools and resources needed by traders to accurately execute trades. XERA is currently partnering with professionals from various industries to help develop a robust trading platform. General objectives of the platform:

Providing an integrated cryptocurrency trading platform for traders and investors;

To prove yourself as possessing the most demanded opportunities on the cryptocurrency market;

Attracting and retaining reliable partners and team members with proven success in the field of cryptocurrency, thereby providing an exceptional trading experience for XERA customers.

In particular, XERA offers traders and investors detailed reporting, advanced charting functions, cancellation of other order functions (OCO), several types of orders, price alert system, real-time profit and loss updates and competitive trading fees. Regardless of whether the user is a novice or an advanced trader, everyone is welcome on the XERA platform.

COMPARISON TABLE

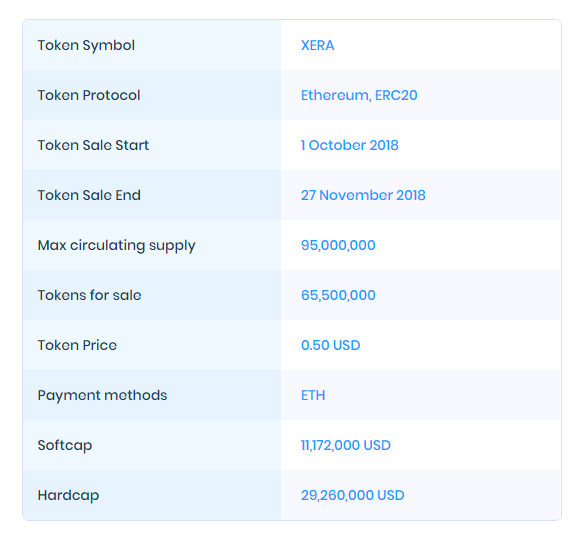

TOKENS

SALE OF TOKENS

The price of the token is $ 0.50, and the blocking period will be valid until the end of the first quarter of 2019. The minimum investment in ICO is 0.1 ETH. Ethereum will be accepted as payment during ICO. The details of the sale of tokens are as follows:

● Total number: 95,000,000 tokens.

● 70% of the offer in ICO for sale: 66,500,000 tokens.

● Soft cap: 26,600,000 tokens (40%).

● Hard cap: 66,500,000 tokens (100%).

● 30% of the reserve: 28,500,000 tokens will go to the reserve for future use for internal purposes.

INCOME MODEL

The XERA revenue model will be based on various trade fees. These fees are as follows:

● Exchange fee. The XERA exchange fee is 0.1%. If you trade in a pair of XERA, the fee will be 0.05%

● Fee for withdrawal of funds. Variable for different coins. Will be mentioned later.

● Listing fees. Will be revealed later.

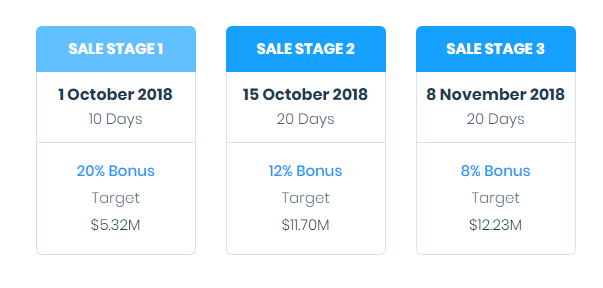

ICO SCHEDULE

The sale of XERA tokens will begin on October 1, 2018 and end on November 27, 2018. The sale of tokens will take place in three stages:

FOR MORE INFORMATION VISIT THE LINK BELOW:

Website: https://www.xera.tech

Telegram Group: https://t.me/xeratechnologies

Twitter: https://twitter.com/agentmile

Facebook: https://www.facebook.com/xerablockchain/

AUTHOR:Sumurbor

ETH:0x748bd5a5753587937fAC0e726B384bDbD2870644

Tidak ada komentar:

Posting Komentar