PAYGINE I will discuss about the Paygine project or the quality of the future platform designed to work within its own ownership structure of banking and this project creates a reliable propesional team in handling all your needs to start a business in crypto.

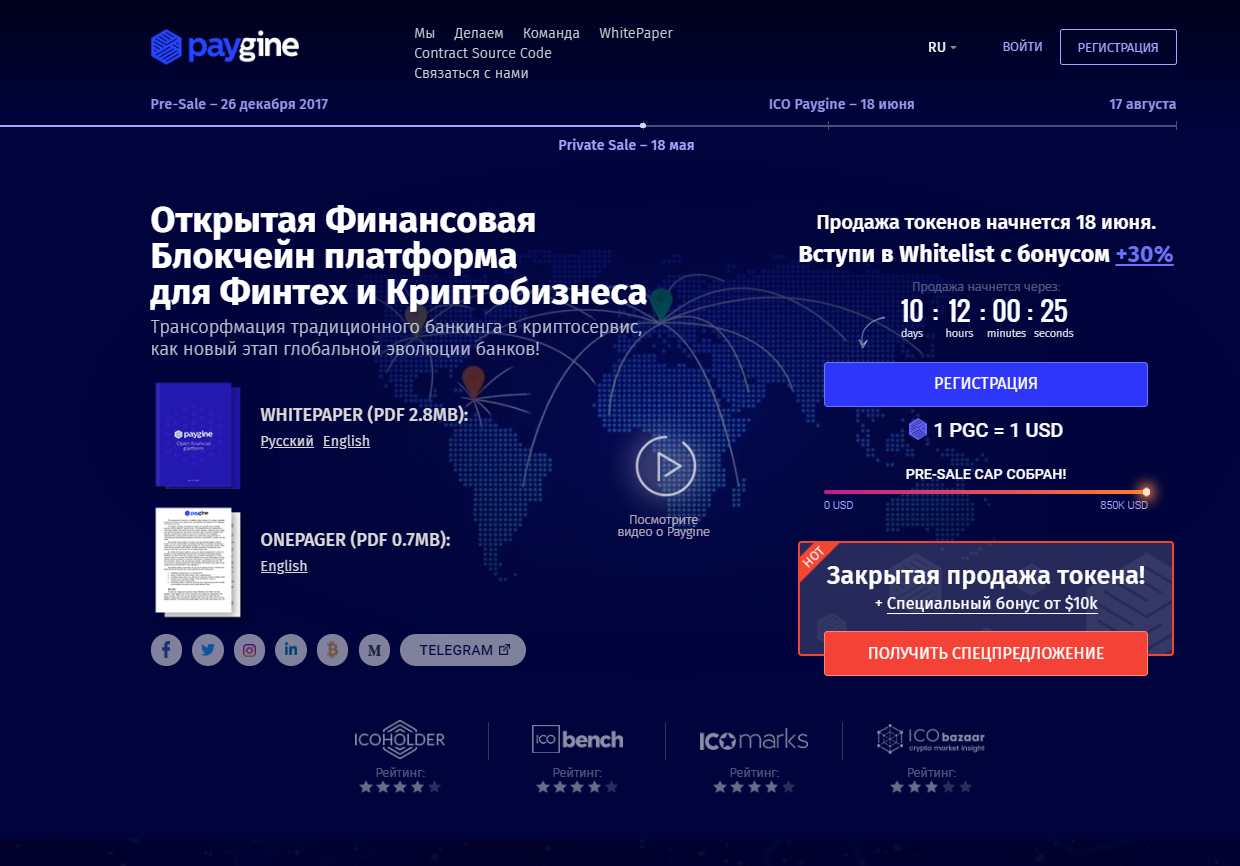

Paygine is an open financial platform designed to serve Finteh and crypto business needs for money transfers, exchange of currencies and payments for "real" goods and services by the White Label solution.

Based on the needs of the international banks and financial institutions, the founders of Best2Pay, decided to create a new platform for the United one with its open API. Paygine's key competitive advantage over similar projects is that it can use existing Best2Pay services and technologies currently used by Finteh Business, e commerce and beyond.

The Paygine platform would offer the following services, using the existing Best2Pay technology:

Transfer of cryptocurrency from a bank card;

pay in shops and stores using a card in cryptocurrency;

acceptance of cryptocurrency as payment for goods and services in online stores;

cross-border transfers of fiat currencies using cryptocurrency at minimal cost;

maintaining wallets in the fiat currency and cryptocurrencies with the ability to conveniently and quickly convert funds between them.

Best2Pay and was founded in the UK in 2012 by experts from the banking sector with experience implementing projects in American Express, SEB, Raiffeisenbank, Bank of St. Petersburg, Russian Standard Bank and Sberbank.

Best2Pay services uses projects from the Fintech area and e-commerce for more than 1.5 million customers, whose number is growing at 34% monthly.

PAYGINE Best2Pay platform allows you to implement a project of any complexity that will take into account the unique features of business processes, infrastructure and client Audience client ...

BEST2PAY - MARKET LEADER FOR ONLINE REPEATED PAYMENT OF CREDITS AND PEER2PEER TRANSFER

Best2Pay in monthly income, repayment of loans and peer-2-peer transfers for 2015-2017 (USD)

We came up with the idea of creating an open financial platform that includes our own banks (owned by the founders of the platform) in 2017. At that time, together with our partners, we are launching a money transfer system based on bitcoin money transfers from the USA to Mexico. We developed the IT system, solved all legal issues with the help of lawyers and received legal opinion, which confirmed the legality of our operations and actions.

It seemed that only one small thing was not enough - to find banks that were ready to cooperate, and there began our problems. Once they found out that we were going to use Bitcoin as a method of payment, the banks would immediately refuse to service us, despite all the documents and legal opinions provided. We were faced with the same problem when we were trying to create a last mile transfer service in Europe. All decisions were too complicated - with a lot of intermediaries - and do not guarantee stable work for more than 1 or 2 months, even considering that, in addition to legal opinion, we fulfilled all the requirements of the CFT / FCA. But it will not help. Banks and financial institutions simply refused to work with us, when they heard "bitcoin", there is no real reason at all!

The second problem we faced in the United States of America and Europe was that even if some financial institutions did not stop talking after hearing "bitcoin", it turned out they simply did not have any white label options and could not provide us with all the services we needed through the API . This led to our customers, PAYGINE having direct contact with our partners, to submit many documents, to use their interface, etc.

As we learned later, more than 79% of Finteh startups and CME-related encryption are struggling with these two problems. At present, according to various estimates, the total cryptocurrency of market capitalization has exceeded several hundred billion US dollars, and most of this money is not provided for the real economy or for real people in their daily lives!

DISTRIBUTION OF MARKERS

and projected use of income

Name and logo of the marker: PGC

Price: 1.00 PGC = 1.00 USD

Blockchain: Ethereum, ERC20

Using the marker: after the project is launched, each owner will have the right to pay for goods or services using markers in the ratio 1 PGC = 1 USD.

All unsold tokens will be sent to thereserve for use on the Paygine platform in the future.

Markers distributed among investors of the project will be

41,508,000 PGC (27.92%)

Markers distributed among project team members will be

22 500 000 PGC (14.71%)

Markers allocated to the reserve will be

87,742,392 PGC (56.59%)

Markers, retired to Bounty will be

1 191 608 PGC (0.78%)

Scheme of distribution of funds:

Buying Bank (64.9%)

Staff (18.3%)

Legal costs (registration, licenses, consultations) (4.8%)

Operational expenses (0.3%)

Lease (1.3%)

Buying the software and its configuration (10.3%)

DETAILED INFORMATION:

Website: https://www.paygine.com

Feature story: https://www.paygine.com/assets/helpers/files/en.pdf

Ann stream: https://bitcointalk.org/index.php?topic=2916009

Telegram: https://t.me/paygine_official

Facebook: https://www.facebook.com/paygine

Twitter: https://twitter.com/paygine

AUTHOR:Sumurbor

ETH:0x748bd5a5753587937fAC0e726B384bDbD2870644

Tidak ada komentar:

Posting Komentar